My Money Don’t Jiggle Jiggle:

Securing Financial Stability

Introduction

In this comprehensive guide, we will delve into the realm of financial stability and explore strategies to ensure that your hard-earned money stays securely in place. With a focus on the keyword “my money don’t jiggle jiggle,” we will provide valuable insights and expert advice to help you achieve financial stability and build a prosperous future.

Understanding the Phrase “My Money Don’t Jiggle Jiggle”

The phrase “my money don’t jiggle jiggle” emphasizes the significance of financial stability and the need to prevent unnecessary fluctuations in your finances. It serves as a reminder to be diligent in managing your money, making informed decisions, and adopting effective financial habits to safeguard your financial well-being.

The Significance of Financial Stability

Financial stability is crucial for individuals and families to thrive and lead fulfilling lives. It provides a solid foundation that allows you to meet your financial obligations, pursue long-term goals, and navigate unforeseen expenses with confidence. By prioritizing financial stability, you can reduce stress, improve overall well-being, and unlock opportunities for growth and prosperity. Let’s explore key steps you can take to achieve and maintain financial stability.

Key Steps to Attain Financial Stability

1. Budgeting: Taking Control of Your Finances

Budgeting is the cornerstone of financial stability. It empowers you to track your income and expenses, identify areas for potential savings, and allocate funds wisely. By creating a comprehensive budget, you can make conscious choices about your spending, avoid debt traps, and establish an emergency fund for unexpected circumstances.

2. Saving: Building a Safety Net

Saving plays a pivotal role in securing financial stability. By consistently setting aside a portion of your income, you can create an emergency fund to weather financial storms and build long-term wealth. Start by initiating small savings contributions and gradually increase them as your financial situation improves.

3. Debt Management: Breaking Free from the Cycle

Debt can undermine your financial stability and hinder progress toward your goals. It is crucial to develop a well-defined plan to pay off high-interest debts systematically. Explore consolidation options, seek professional guidance if needed, and adopt strategies to effectively manage and reduce your debt burden. By regaining control over your debt, you pave the way for financial stability.

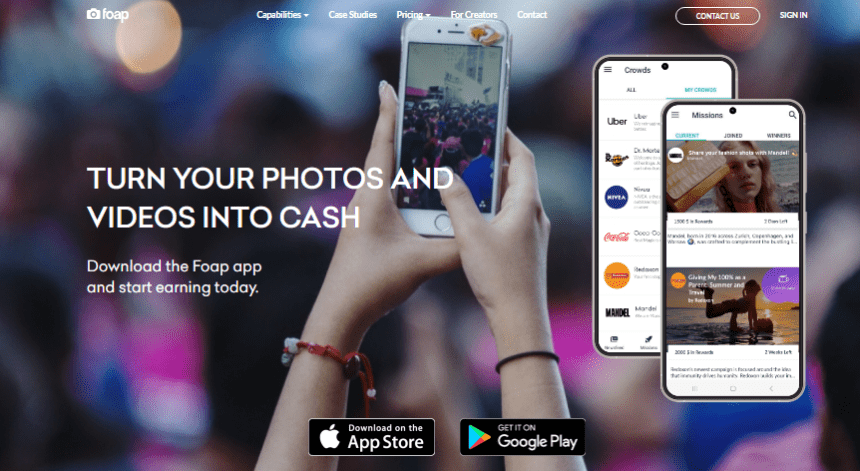

4. Investment Strategies: Growing Your Wealth

Investing presents an avenue for growing your wealth and attaining long-term financial stability. Conduct thorough research on investment options such as stocks, bonds, real estate, and mutual funds. Diversify your portfolio to mitigate risks, and consider seeking advice from a knowledgeable financial advisor to make informed investment decisions aligned with your goals.

5. Insurance: Safeguarding Your Assets

Insurance serves as a crucial safeguard for maintaining financial stability. Assess your insurance needs, including health insurance, life insurance, home insurance, and auto insurance. Select policies that adequately protect your assets and cater to your specific circumstances. Insurance provides a safety net during unforeseen events and protects your financial well-being.

Frequently Asked Questions (FAQs)

1. How can I create an effective budget?

Creating an effective budget requires assessing your income, tracking expenses, and setting realistic goals. Begin by listing all your sources of income and categorizing your expenses. Analyze your spending patterns and identify areas where you can make adjustments. Set specific financial goals, allocate funds accordingly, and regularly monitor your budget to make necessary adjustments.

2. What are some practical tips for saving money?

- Automate your savings by setting up recurring transfers from your checking account to a designated savings account.

- Trim unnecessary expenses, such as eating out or impulse purchases, and redirect those funds towards savings.

- Compare prices, shop around, and take advantage of discounts and coupons whenever possible.

- Consider exploring frugal living strategies, such as meal planning, energy-saving measures, and DIY projects.

3. How can I effectively manage and reduce my debt?

- Prioritize your debts by focusing on high-interest ones first while making minimum payments on others.

- Explore debt consolidation options to streamline your repayments and potentially lower your interest rates.

- Seek professional advice from credit counseling services or financial advisors experienced in debt management.

- Stay disciplined and avoid accumulating additional debt while working towards paying off existing obligations.

4. What should I consider when investing for financial stability?

- Educate yourself about different investment options and their associated risks and rewards.

- Diversify your portfolio to spread risks across multiple investments and asset classes.

- Set clear investment goals and establish a long-term investment strategy aligned with your risk tolerance.

- Regularly review and rebalance your portfolio to ensure it remains in line with your objectives and market conditions.

5. How does insurance contribute to financial stability?

- Insurance provides protection against unforeseen events and mitigates financial losses.

- Adequate health insurance safeguards your well-being by covering medical expenses.

- Life insurance offers financial support to your loved ones in the event of your untimely demise.

- Home and auto insurance protect your valuable assets from damage, theft, or accidents.

Conclusion

Achieving and maintaining financial stability is a lifelong journey that requires discipline, planning, and informed decision-making. By adopting key strategies such as budgeting, saving, debt management, investing, and insurance, you can pave the way toward a secure financial future. Remember, “My money don’t jiggle jiggle” when you prioritize stability and take control of your finances.